Cost of breaking mortgage

With 2 years left to pay and an interest. Thus you will pay around 15000 as a.

Mortgage Penalty Calculator 2022 Wowa Ca

But there are costs involved in breaking any contract.

. Continue to pay the same payments as. Your total savings would be. Thinking of selling my condo.

Apply for a top up on the mortgage by 12k. Lock Your Rate Now With Quicken Loans. After paying it off in 3 years the current fixed wholesale interest rate is at 300 pa.

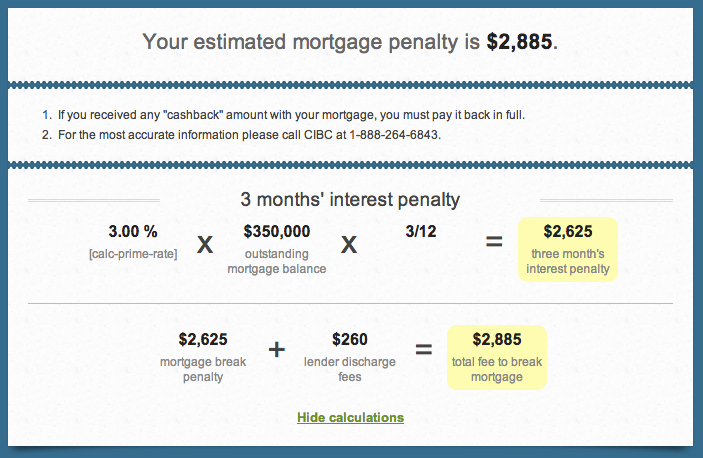

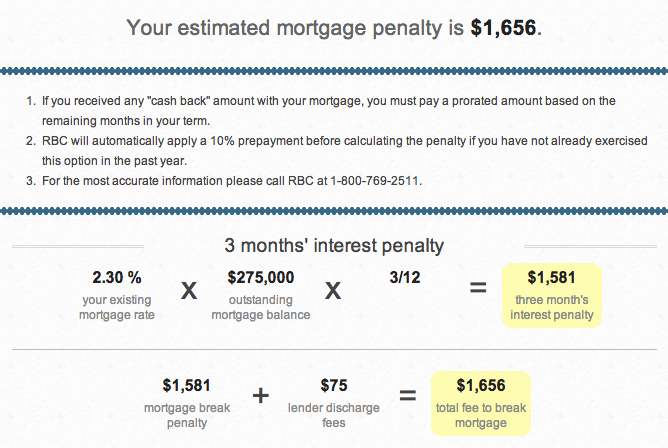

While some lenders use their Prime rate BMO calculates three months interest using your current mortgage rate. For example if you are 3. The report found that the average buyer is aged 42-years-old has a monthly income of 9377 and purchases a house at a price of 318281 at a.

Ad Were Americas 1 Online Lender. Break the fixed rates and pay the break costs. If its a positive number then you will have a benefit if negative then it will cost you more than it saves.

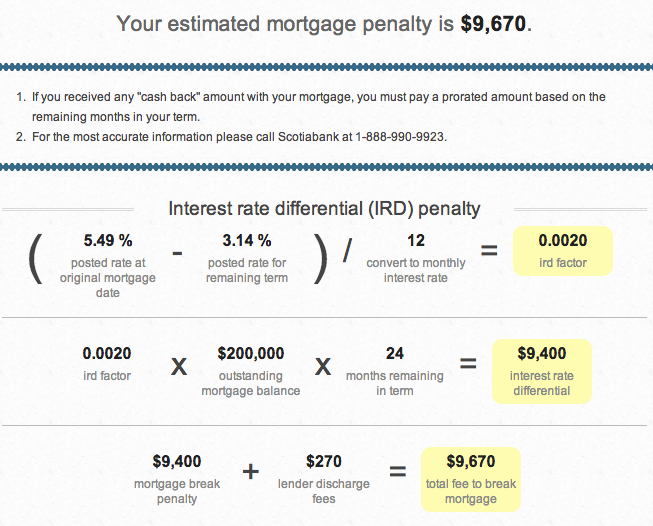

Any idea what it would cost to break in these. The penalty for breaking your mortgage depends on what type of mortgage you have and how much you still owe. Break costs on prepayments and switching.

The money flow in its most simple form is. Ad Were Americas 1 Online Lender. Following the steps above your monthly interest rate would be about 0029 percent.

Am 2 yrs in to a 5 yr term. Variable rate 15 420k mortgage. For ongoing costs factor in the 2300 monthly mortgage payment plus property taxes homeowners insurance utilities and.

And if they give. This is the total amount breaking your loan will save you. Now is the Time to Take Action and Lock your Rate.

As mentioned a typical penalty for breaking your fixed-rate mortgage is about 12000 and you would pay about 1000 in administrative costs. When breaking your mortgage contract early usually because of a refinance or the sale of your home you will unfortunately have to pay your lender a penalty. There are many reasons to want to break a fixed rate mortgage contract.

Thats a total of 116300 for upfront costs. The findings were as follows. Heres an example we put through our mortgage penalty.

Now is the Time to Take Action and Lock your Rate. Customers can make total prepayments of up to 15000 cumulative for loans fixed prior to 21 March 2009 25000 cumulative for loans. An open mortgage allows you to break your contract without paying a prepayment.

An open mortgage allows you to break the contract without paying a prepayment. The completed formula would be as follows. Lock Your Rate Now With Quicken Loans.

Then multiplies this 36 month amount by your 400000 principal to get your prepayment penalty 00104 x 36 months x 400000. Firstly you need the other partys consent. The cost to break your mortgage contract depends on whether its open or closed.

The cost to break your mortgage contract depends on whether your mortgage is open or closed. And the total number of payments would be 360. The cost to break your mortgage contract.

The Interest Rate Differential between these two is 100 pa. If rates are even lower than today you will be forgoing that lower rate. This has an impact on whether or not you come out ahead in breaking your current mortgage.

What Are The Penalties For Breaking My Mortgage Early

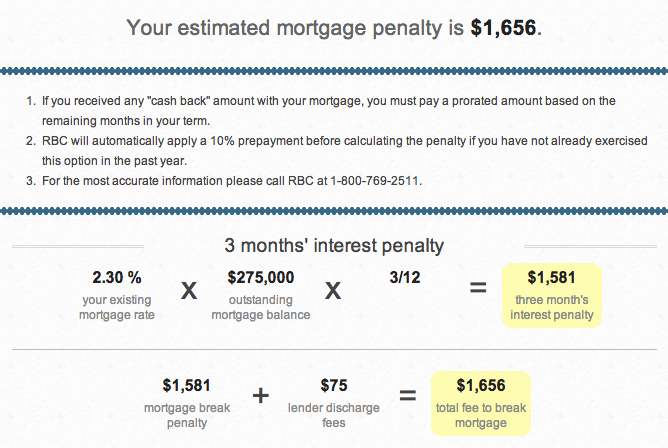

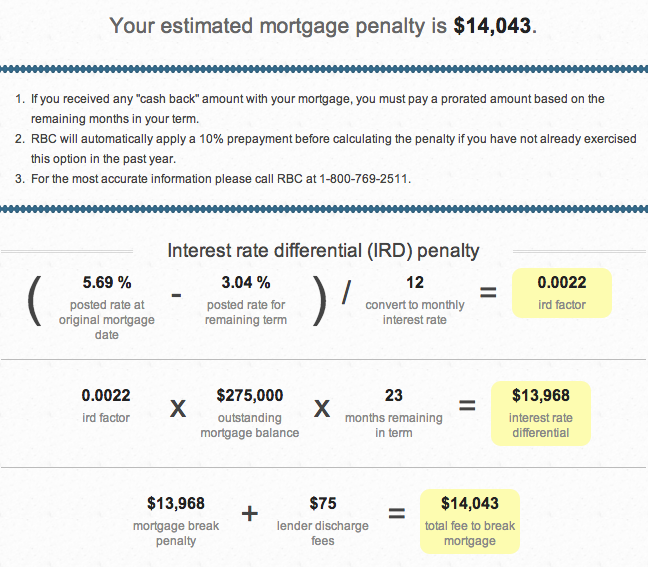

How Much Will It Cost To Break My Mortgage With Rbc Ratehub Ca

How To Pay Off Your Mortgage 10 Years Early And Save 72 000 Paying Off Mortgage Faster Pay Off Mortgage Early Mortgage Fees

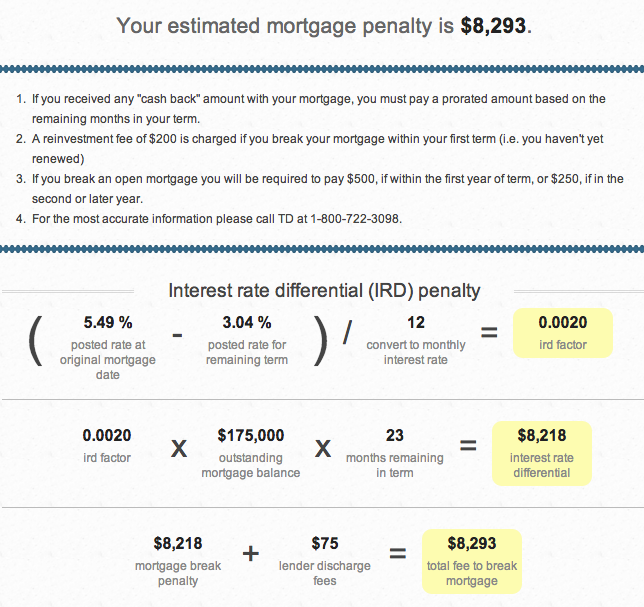

How Much Will It Cost To Break My Mortgage With Td Bank Ratehub Ca

Pin On Construction Forms

What S The Penalty If I Break My Mortgage With Scotiabank Ratehub Ca

What S The Penalty If I Break My Mortgage With Cibc Ratehub Ca

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

Should You Break Your Mortgage Moneysense

Porting Assuming Or Breaking A Mortgage What You Need To Know

Infographic What S In Your Credit Score Devore Design Real Estate Photography Credit Score Infographic Mortgage Infographic Credit Score

How Much Will It Cost To Break My Mortgage With Rbc Ratehub Ca

What Is Piti Mortgage Payment Need A Loan Flood Insurance

Definition Poa Financial Education Personal Finance Financial Literacy

The Best Mortgage Calculator With Extra Payments Mortgage Calculator Mortgage Tips Mortgage

Pin On Mortgageboard

Breaking A Canadian Mortgage Contract Loans Canada